December 2024:

European Foundry Industry Sentiment Indicator, December 2024: Weak demand and high costs drive sentiment down

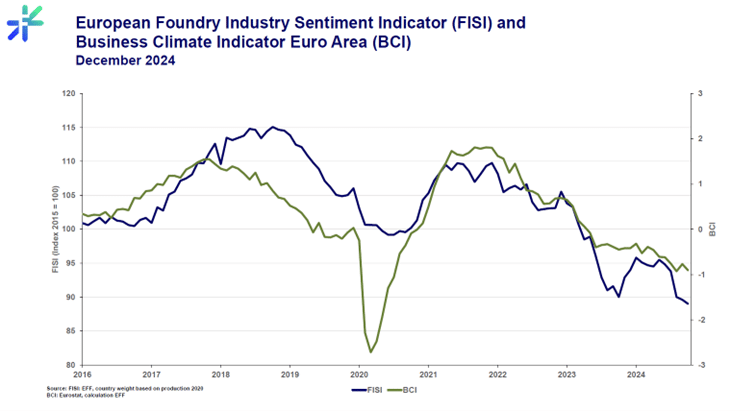

In December 2024, the European Foundry Industry Sentiment Indicator (FISI) declined slightly, reaching 89.0 index points compared to 89.6 in November. This marks a continuation of the challenging environment faced by the European foundry industry, as the sentiment remains significantly below the neutral 100-point threshold. The decrease reflects persistent uncertainties in the broader economic and industrial landscape.

The ongoing contraction in the manufacturing sector has been a key factor influencing the FISI. Recent data indicate a sharp downturn in industrial production across Europe, with German industrial orders falling notably. Weak demand from key downstream industries, such as automotive and machinery, continues to weigh heavily on foundries. Moreover, ongoing geopolitical uncertainties, particularly concerning global trade, have exacerbated the difficult operating conditions. For instance, the possibility of increased trade tensions has raised concerns over supply chain disruptions and cost pressures. Another significant factor impacting sentiment is the sluggish recovery in energy-intensive sectors. Foundries, heavily reliant on stable and affordable energy supplies, have struggled with elevated energy costs throughout the year. Although there has been some stabilization in recent months, energy price volatility remains a concern, deterring investment and dampening confidence.

Looking back to 2024, the FISI began the year at 96.2 index points, reflecting cautious optimism within the industry. However, as economic headwinds intensified, the indicator steadily declined and remained below 100 points throughout the year. By the fourth quarter, sentiment had fallen to its lowest level, with December’s score of 89.0 underlining the cumulative impact of high costs, bureaucracy, weak demand and geopolitical instability. This downward trajectory highlights the significant challenges the sector has faced in adapting to an evolving economic landscape.

Despite these challenges, there is cautious hope that structural adjustments and policy measures could provide some relief by 2025. For now, the European foundry industry continues to navigate a complex mix of pressures, with resilience and adaptability remaining key to recovery.

In December 2024, the Business Climate Indicator (BCI) experienced a decline, moving from ‑0.77 in November to ‑0.91. This downturn reflects heightened pessimism among European businesses, particularly in Germany, where the ifo Business Climate Index fell to 84.7 points, marking its lowest level since May 2020.

Several factors contributed to this decline. The manufacturing sector faced significant challenges, with companies reporting dissatisfaction with current business conditions and expressing increasingly gloomy expectations. The situation regarding business orders worsened, leading to announced production cutbacks. These developments underscore the persistent challenges within the European business environment, as firms navigate ongoing economic uncertainties and sector-specific difficulties.

The FISI – European Foundry Industry Sentiment Indicator – is the earliest available composite indicator providing information on the European foundry industry performance. It is published by CAEF the European Foundry Association every month and is based on survey responses of the European foundry industry. The CAEF members are asked to give their assessment of the current business situation in the foundry sector and their expectations for the next six months.

The BCI – Business Climate Indicator – is an indicator published by the European Commission. The BCI evaluates development conditions of the manufacturing sector in the euro area every month and uses five balances of opinion from industry survey: production trends, order books, export order books, stocks and production expectations.

EFF Contact:

Johannes Kappes

Secretary Commission for Economics & Statistics

phone: +49 211 68 71 — 291

mail: secretarygeneral@eff-eu.org