January 2025:

European Foundry Industry Sentiment Indicator, January 2025: FISI shows Improvement in January 2025

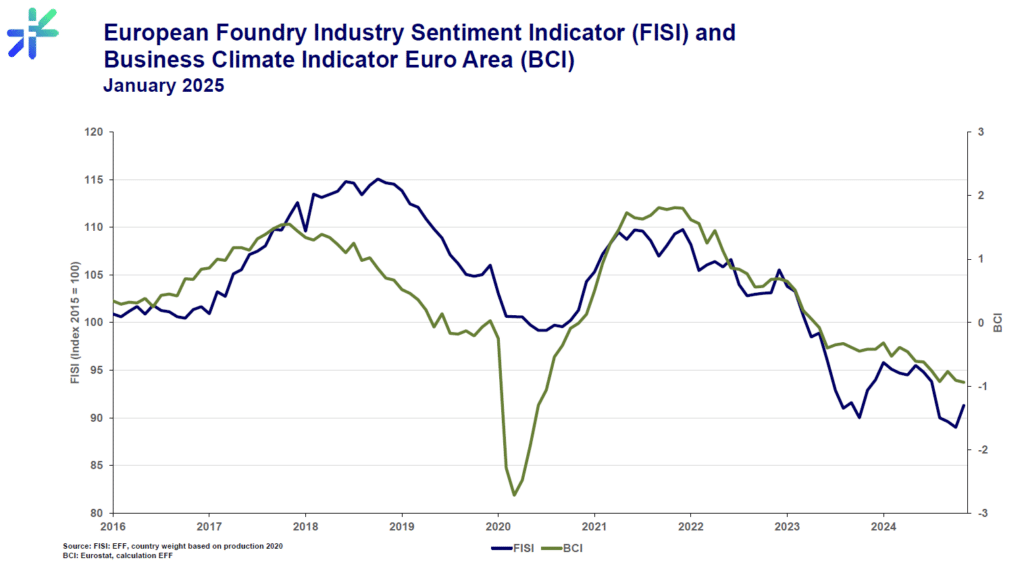

In January 2025, the European Foundry Industry Sentiment Indicator (FISI) increased to 91.3 index points, up from 89.0 in December 2024. This rise suggests a modest improvement in the industry’s outlook, moving closer to the neutral 100-point mark. This development is partly due to positive expectations for the second half of 2025, as businesses anticipate potential growth and stabilization in demand.

Recent data indicate signs of stabilization in the eurozone’s manufacturing sector. The eurozone manufacturing Purchasing Managers’ Index (PMI) rose to 46.6 in January, up from 45.1 in December, approaching the 50-point threshold that separates growth from contraction. This improvement is attributed to factors such as firms looking past rising costs and potential U.S. tariffs, as well as an increase in new orders, which reached an eight-month high. Additionally, the European Central Bank’s recent interest rate cut and potential further reductions may support businesses and consumers. Confidence surged to its highest in nearly three years, suggesting a more optimistic view of the future. Energy prices have slightly moderated compared to their peak, alleviating some cost pressures for foundries. However, elevated grid costs and inflationary pressures persist, continuing to challenge operational efficiency. In response, many foundries are implementing supply chain adjustments and adopting more resilient strategies to mitigate risks associated with energy volatility and geopolitical uncertainties.

Looking ahead, there is cautious optimism for the second half of 2025. The stabilization in manufacturing activity and the potential for further policy measures to support the economy contribute to a more positive outlook. While challenges remain, the industry is positioning itself to capitalize on emerging opportunities, anticipating growth in the latter part of the year.

In January 2025, the Business Climate Indicator (BCI) declined from ‑0.91 in December to ‑0.94, indicating a continued sense of caution among European businesses. This downturn reflects ongoing challenges, particularly within the manufacturing sector, which continues to face pressures such as high energy costs and reduced consumer demand.

Despite these challenges, there are signs of cautious optimism. The euro zone’s GDP growth is expected to hover around +1.0% in 2025, up slightly from +0.7% in 2024. These developments suggest that while the BCI has decreased, there is potential for recovery in the coming months as firms adjust to the changing environment.

The FISI – European Foundry Industry Sentiment Indicator – is the earliest available composite indicator providing information on the European foundry industry performance. It is published by CAEF the European Foundry Association every month and is based on survey responses of the European foundry industry. The CAEF members are asked to give their assessment of the current business situation in the foundry sector and their expectations for the next six months.

The BCI – Business Climate Indicator – is an indicator published by the European Commission. The BCI evaluates development conditions of the manufacturing sector in the euro area every month and uses five balances of opinion from industry survey: production trends, order books, export order books, stocks and production expectations.

EFF Contact:

Johannes Kappes

Secretary Commission for Economics & Statistics

phone: +49 211 68 71 — 291

mail: secretarygeneral@eff-eu.org