July 2024:

European Foundry Industry Sentiment, July 2024: FISI Experiences Slight Uptick in July

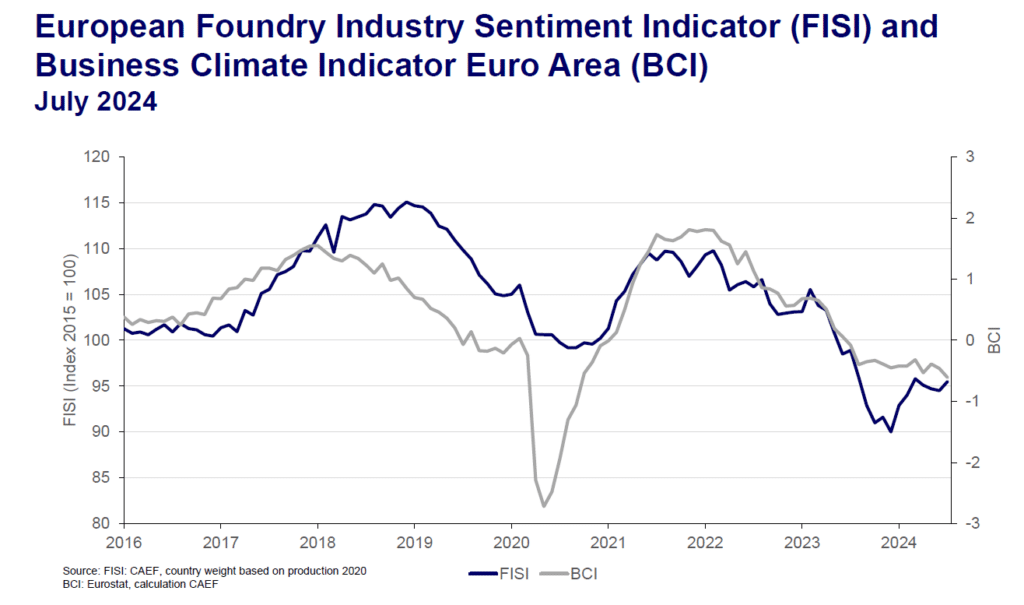

In July 2024, the European Foundry Industry Sentiment Indicator (FISI) saw a slight upward movement, rising to 95.5 index points. This represents an increase of 1.0 point compared to the previous month, where the index stood at 94.5. This modest improvement in the FISI can be attributed to a combination of factors currently influencing the European economy. Firstly, there has been a slight relief and a more optimistic outlook in the broader European economic landscape. Recent indicators suggest that while challenges remain, there is a growing sense of stability that has positively impacted several industrial sectors, including the foundry industry. Secondly, the summer break has resulted in a reduced volume of data, which can occasionally lead to less precise measurements in the index. However, the general trend remains positive despite this seasonal variability. Finally, the automotive sector has shown signs of recovery, providing a much-needed boost to the foundry industry. The renewed demand for automotive components has contributed to the overall improvement in the FISI, reflecting the sector’s importance as a key driver of foundry output in Europe.

While this increase is a welcome development, it is essential to approach the numbers with caution. The broader economic environment remains complex, and the foundry industry continues to face significant challenges. Nonetheless, the positive influences of economic optimism, seasonal factors, and sector-specific resilience have collectively contributed to this slight improvement in the FISI for July.

Meanwhile, the Business Climate Indicator (BCI) has experienced a further decline, decreasing from ‑0.46 to ‑0.61 index points in July. This continued drop highlights the persistent challenges within the business environment, as the BCI remains firmly below the critical threshold of 0 index points. The downturn in the BCI for July can be attributed to several factors. Firstly, there has been a more negative assessment of order book levels, reflecting a weaker demand outlook within the industry. This decline in orders suggests growing concerns about future production capacity and demand. Secondly, the typical slowdown during the summer break has further dampened economic activity, contributing to the overall decline. Lastly, uncertainty surrounding the upcoming EU Commission, and the potential policy changes it may bring has caused hesitancy among businesses, exacerbating the already cautious market sentiment. These factors combined have resulted in a more pessimistic business climate, as companies remain wary of both immediate and future economic conditions.

The FISI – European Foundry Industry Sentiment Indicator – is the earliest available composite indicator providing information on the European foundry industry performance. It is published by EFF the European Foundry Association every month and is based on survey responses of the European foundry industry. The EFF members are asked to give their assessment of the current business situation in the foundry sector and their expectations for the next six months.

The BCI – Business Climate Indicator – is an indicator published by the European Commission. The BCI evaluates development conditions of the manufacturing sector in the euro area every month and uses five balances of opinion from industry survey: production trends, order books, export order books, stocks and production expectations.

EFF Contact:

Johannes Kappes

Secretary Commission for Economics & Statistics

phone: +49 211 68 71 — 291

mail: info@eff-eu.org