June 2024:

European Foundry Industry Sentiment, June 2024: FISI continues with sideways trend in June.

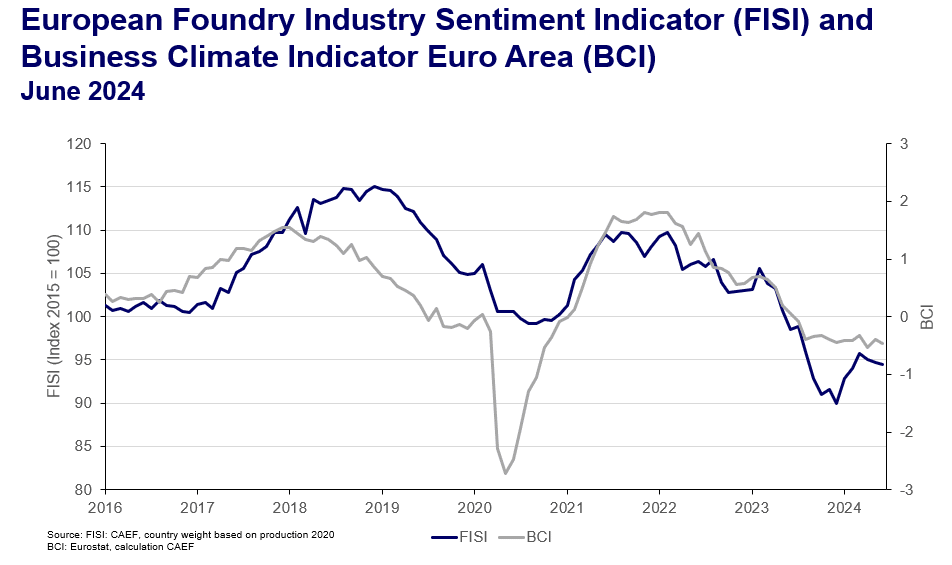

In June 2024, the European Foundry Industry Sentiment Indicator (FISI) experienced a slight decrease to 94.5 index points. This development reflects the third consecutive decrease for the FISI, with the index experiencing a downward movement of 0.2 points, settling at 94.5 compared to 94.7 in the previous month. In the current month, the FISI has demonstrated steadiness, exhibiting minimal fluctuations. This lack of significant movement can be traced back to a confluence of factors that have collectively influenced this outcome. The first factor to consider is the noticeable deceleration in the economies of the larger European nations. This has created a ripple effect, impacting various sectors including the performance of the FISI. Secondly, the industry is currently clouded by a substantial degree of uncertainty regarding its future. This uncertainty, fueled by unpredictable market trends and shifting investor sentiments, has contributed to the static behaviour observed in FISI. Third, it’s important to highlight the role of heavy subsidies provided to foundries in non-European Union countries. These subsidies have enabled these foundries to undercut the costs of their European counterparts, creating a challenging competitive landscape. This has further added to the economic pressures influencing the performance of financial instruments like FISI. An additional factor are the recent election results from the European Union. The political shifts and policy changes that often follow such events can create an environment of hesitancy among investors, leading to less movement in the market.

Meanwhile the Business Climate Indicator (BCI) has experienced a slight decline,decreasing from ‑0.39 to ‑0.46 index points in June. This marks yet another month where the BCI remains entrenched below the critical threshold of 0 index points, reflecting ongoing challenges within the business environment. The recent downturn in the BCI can be attributed to several key factors. Firstly, there has been a noticeable deceleration in the production trend, which had previously shown signs of improvement. This slowdown indicates that the initial momentum in production activities has not been sustained. Secondly, the assessment of export order-book levels has not shown significant growth, remaining relatively stable and reflecting persistent uncertainties in international trade dynamics. Lastly, expectations for selling prices in the coming months have also plateaued, suggesting that market conditions are still volatile and unpredictable.

The FISI – European Foundry Industry Sentiment Indicator – is the earliest available composite indicator providing information on the European foundry industry performance. It is published by EFF the European Foundry Association every month and is based on survey responses of the European foundry industry. The EFF members are asked to give their assessment of the current business situation in the foundry sector and their expectations for the next six months.

The BCI – Business Climate Indicator – is an indicator published by the European Commission. The BCI evaluates development conditions of the manufacturing sector in the euro area every month and uses five balances of opinion from industry survey: production trends, order books, export order books, stocks and production expectations.

EFF Contact:

Johannes Kappes

Secretary Commission for Economics & Statistics

phone: +49 211 68 71 — 291

mail: johannes.kappes@EFF.eu